Download IndiaBonds App

100K+ Downloads

Invest in Bonds & FDs Online

₹ 10,000

Minimum Investment

2,25,000+

Registered Users

₹ 4,000 Cr+

Bonds Transacted Online

What are Corporate Bonds?

Earn up to 12%* on listed & rated Corporate Bonds in India

Earn up to 12%* on listed & rated Corporate Bonds in India

Explore Now

*T&C Apply

What are Corporate Bonds?

Earn up to 12%* on listed & rated Corporate Bonds in India

Earn up to 12%* on listed & rated Corporate Bonds in India

Explore Now

*T&C Apply

What are Corporate Bonds?

Earn up to 12%* on listed & rated Corporate Bonds in India

Earn up to 12%* on listed & rated Corporate Bonds in India

Explore Now

*T&C Apply

What are Bonds?

What are Bonds?Offers and Categories

View All

Indiabonds | 5 min

Indiabonds | 5 min

CIN: U67100MH2008PTC178990 |

SEBI Registration No.: INZ000311637 |

NSE Member ID - Debt Segment: 90316 |

BSE Member ID - Debt Segment: 6811

*Numbers as on specific date.

Disclaimer : Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.

About Us

IndiaBonds is a fintech company driven by technology with a passion to create a Bond investment platform that provides investors access to the Bond market in a low-cost, transparent and easy to use manner.

We assist investors by providing them with opportunities to access a wide choice of bond investments in India that may provide consistent and good returns, thus helping them in generating predictable cash-flow and meeting their investment objectives. Our endeavor is to empower individual investors with education and information on the Bond Market so that every investor can make an informed decision.

The underlying principle of our operation is synergizing automation and machine learning into the core of our business so we can act as a catalyst to the growth of bond Investments in India by passing on the power in the hands of investors by means of innovations. Our focus concentrates towards making investments in the bond market an easy and convenient experience for investors as well as becoming a one stop solution for anything pertaining to Bonds in India.

IndiaBonds’ Core management team comes with over 100 years of collective experience enriched with both equity and Fixed Income Market specifically on Bond Investments. Their extensive experience and knowledge of the industry makes them veterans of Debt Markets. The team is built by a group of experts with proficiency in different domains that complements the organization’s growth strategy towards building a successful fintech organization for corporate bonds market in India.

Why should you Invest in Bonds?

While there are several different types of Bonds in Indian Market, investors must invest in bonds basis their investment goals and objectives. Investing in Bonds and Debentures are a great way to add stability to your portfolio. That is also reason why most seasoned investors believe Bond Investments play a crucial role in the overall health of their financial portfolio. The first key advantage that investors stand to gain when they invest in Bonds is that it helps in portfolio diversification. What this essentially means is that you distribute your investments across varied investment options that help individually contribute to your growth goals and in the process also help mitigate the portfolio risk. The second key factor why investors must consider Bonds Investment is that Bonds help you earn fixed, regular higher income in comparison to other traditional fixed income investments like Bank Fixed Deposits and Corporate Fixed Deposits. Bonds are also considered to be highly liquid since public bonds are easily tradeable on exchange. This means investors can exit their investments with limited hassles in case of an emergency. Another key factor that makes Bonds a desirable investment option is the advantage bond holders enjoy in the event of bankruptcy. As shareholders and owners, equity holders are last to receive their investments and therefore stand a risk to losing out on their entire investments. However, Bond investors stand to receive their money first by disposing off the securities that back these bonds, as bonds investors are considered lenders or creditors. Bonds Investments can also incentivize investors with tax benefits depending on the kind of bond they invest in. For example, tax free bonds help you earn interest income that is tax exempt.

Why IndiaBonds?

The Bond Market today oversees colossal potential growth in the coming years. The revolution this industry will go through is dependent on platforms like us to provide our customers with competencies to churn out ground breaking innovations to improve your experience when you invest in Bonds in India. As a fintech, one of IndiaBonds’ core principle orbits around Tech innovations and revolutions. We do not just believe in selling bonds online but creating innovative tools for investors which will help them take investment decisions.

Here are a few advantages you stand to benefit when you decide to purchase bonds online through IndiaBonds:

- Access outstanding or active Bonds in Indian market all under one roof through IndiaBonds Bond Directory to help you make an informed choice.

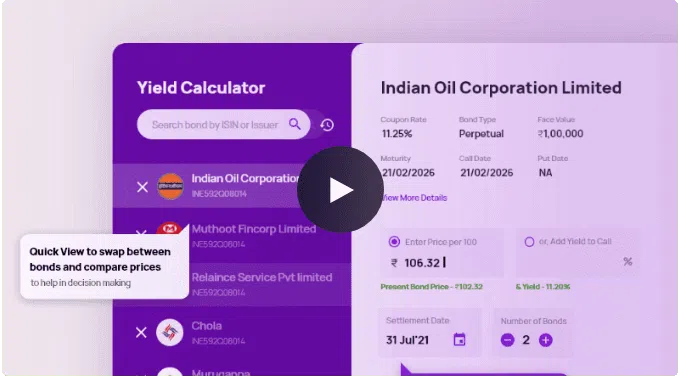

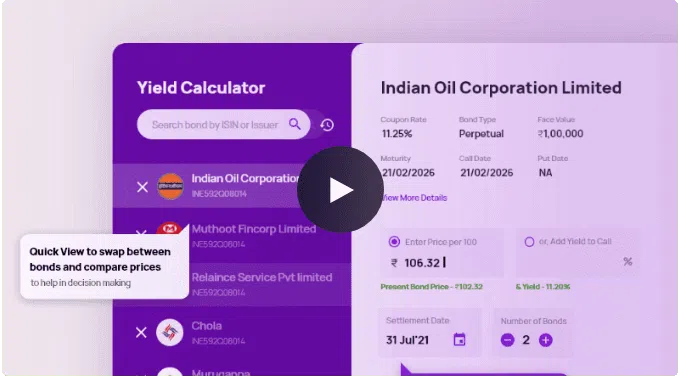

- Sign up and access the Bond Calculator to calculate the Bond Price, Yield and know the exact settlement amount before you decide to buy Bonds Online.

- When you invest with IndiaBonds you can rest easy since you get access to transparent prices without any hidden or additional charges.

- Pay zero brokerage or commission when you purchase bonds online through the secondary market.

- All your payments are made directly to SEBI regulated Clearing Houses when you Buy Bonds Online through IndiaBonds. Your funds do not touch IndiaBonds at all.

What are the various forms of Bonds and Debentures in India?

Technically, Bonds as a term are used to denote the issuances that are issued by the Government. Whereas the term debentures are used for issuances made by corporates. However, colloquially, both Bonds and Debentures as a nomenclature are interchangeably used. Bonds in India can be categorized either by Issuer type or by means of Issue Structure. When it comes to the Issuer Type, Bonds are primarily issued either by

• Corporates

• Government

- Central government

- State Government

• PSUs

• Bank or

• NBFCs

Government Bonds are issued both by the Central Government as well as State Government. Bonds issued by Central Government are called as Government Bonds whereas Bonds issued by the state government are called as State Developmental Loans.

Similarly, when it comes to bond structure, following are the structures or features by which Bonds in India can be classified.

• Fixed Coupon Rate Bonds

• Floating Coupon Rate Bonds

• Zero Coupon Bonds • Callable and Puttable Bonds

• Subordinated Bonds

• Perpetual Bonds

• Tax Free Bonds

• Covered Bonds

• Principal Protected Market Linked Debentures

• Capital Gain Bonds

What is a Fixed Deposit?

A Fixed Deposit (FD) is a regulated financial instrument overseen by the Reserve Bank of India (RBI) and offered by banks, corporates, and Non-Banking Financial Companies (NBFCs). It enables you to invest a lump sum for a defined tenure at a predetermined interest rate. Depending on the terms, the interest rate can be fixed or floating, providing a secure and predictable return on your investment.

What are the benefits of investing in fixed deposits?

Safety

FDs are one of the safest investment options, offering protection against market volatility, making them ideal for conservative investors.

Attractive Returns

NBFC FDs often provide higher interest rates compared to regular bank FDs, allowing you to maximize your earnings.

Flexible Tenure

You can choose from a wide range of tenures to match your financial goals, whether short-term needs or long-term savings.

Fixed Returns

The interest rate is fixed at the time of investment, ensuring predictable and stable returns throughout the tenure.

Periodic Payout Options

Many NBFC FDs offer periodic interest payout options, such as monthly, quarterly, or annually, making them suitable for individuals looking for regular income.

These benefits make fixed deposits a reliable and relatively safer investment option for individuals seeking peace of mind and consistent returns.

FAQ

1. How to invest in Bonds Online through IndiaBonds?

Bonds Investment through IndiaBonds is a fairly simple process

- The first step is to sign up on Indiabonds.com

- Complete your KYC process online. It’s paperless and requires no uploads. Complete your KYC process in less than 3 minutes

- Shortlist the bond you are interested to invest in, and that’s about it!

2. Do you need a Demat account to invest in Bonds Online?

A Demat account is mandatory for Bond Investments in India. In case you don’t have a demat account, you can easily have it made on request to either your bank or your broker. IndiaBonds team is also happy to facilitate and help you open a demat account.

3. Are Bonds a safe investment option?

As with any investment option, Bonds carry with them a certain degree of risk. Investors are always advised to consult their financial consultants before proceeding with any investment decisions. However, in comparison to other volatile and relatively risky investment options like equity, Bonds Investment are considered to be low risk and stable. This is because most bonds have assets and collaterals attached to them and also offer a legal guarantee to repay bond holders who are considered to be creditors unlike equity holders who are considered to be owners and shareholders and therefore may lose out on all their investments, in the event of a default. Whereas, Bond holders are first in line and therefore get preference in case of repayments. Secondly, bonds issued by the government come with the highest degree of safety and a sovereign commitment to pay timely interest to the investors as well as return the principal.

4. Why do companies and Governments issue Bonds?

Bonds are a form of loan that investors lend to either the government or corporates. These entities issue Bonds in India to raise money to either fund their daily working capital requirements or finance their long term growth and expansion plans. Bonds are a great way for corporates to raise more money without diluting their holdings. Government on the other hand issue bonds for development projects of the nation which could pertain to infrastructure development, power financing, housing and development among several other requirements.

5. What is the interest rate on Fixed Deposits?

Based on your tenure of investments, you get attractive fixed deposit interest rates ranging from 8% – 9.5% currently on IndiaBonds

6. How can I open a Fixed Deposit account?

Opening a fixed deposit account is easy. You just have to sign up on IndiaBonds, complete your KYC on IndiaBonds, choose the FD specifications & make payment.

7. What are the benefits of investing in Fixed Deposits?

High returns, flexible tenures & payout options are some benefits of doing fixed deposits on IndiaBonds.

8.What are Corporate Bonds?

Corporate bonds are debt securities issued by companies to raise capital from investors. When you purchase a corporate bond you are lending money to a company. In return, the company promises to pay you back the principal amount on a specific maturity date, along with regular interest payments, known as coupon payments, throughout the bond's tenure.

9. How to Invest in Corporate Bonds?

Investing in corporate bonds is simpler than most people think. Here’s how you can do it:

• Online Bond Platform Provider (OBPP): SEBI-registered platforms provide a direct and secure way to buy corporate bonds. Most OBPPs offer transparency and a wide range of options, allowing you to compare and invest with ease. Some OBPPs also help in selling your bonds.

• Stock Exchanges: You can buy and sell listed corporate bonds on stock exchanges using your existing demat and trading accounts.

• Mutual Funds: Investing in bond funds is an excellent way to gain exposure to a diversified portfolio of corporate bonds managed by professionals. This option is suitable for those who prefer indirect investment and professional management.

• Private Placements: High-net-worth individuals can participate in private placements, which are exclusive bond offerings from companies not available to the general public.

Before investing, always check the bond’s credit rating, interest rate, and maturity.

10. Salient Features of Corporate Bonds

Corporate bonds offer several features for investors:

• Predictable Returns: Fixed interest payments provide a stable and predictable source of income, which is a key advantage for investors seeking steady cash flow.

• Credit Ratings: Independent credit rating agencies regulated by SEBI, assess the financial health of the bond issuer and assign a rating. This rating helps investors gauge the creditworthiness and reliability of the company.

• Flexibility: Corporate bonds come with various tenures and risk profiles, allowing investors to choose options that best fit their investment horizon and risk appetite.

• Tradability:Many corporate bonds are listed on exchanges, offering liquidity. This means you can sell your bonds in the secondary market before the maturity date if you need to access your funds.

• Taxation:The interest earned on corporate bonds is taxable as per your income tax slab. Capital gains on the sale of bonds are taxed depending on the holding period.

• Security:Some bonds are secured by the company's assets, providing an additional layer of safety for the investor in case the company defaults on its payments.

These features make corporate bonds a compelling investment choice for those who prioritize steady income and capital preservation over the volatility of the stock market.